It makes sense to look at Trafford’s income on its own. Trafford’s income is largely a case of what you see is what you get, with just a few areas of choice, notably the Green Bin charge which goes into reserves.

The Current Budget (25/26)

The cost of Trafford’s current services being delivered for this year is £233m. This has come from:

- Business Rates £81m

- Council Tax £139m

- Reserves £3m

- Capitalisation Direction £10m

It’s worth emphasising that there is absolutely no mention of Government funding. This conceals the enormous impact Government makes on the distribution of collected business rates.

Trafford collects a lot more than £81m from business rates on its businesses. In 24/25 the amount was £152m. So where’s that >£70m gone?

This leaflet was issued prior to a public health settlement that slightly boosted the budget. The figures at the top of this section are correct.

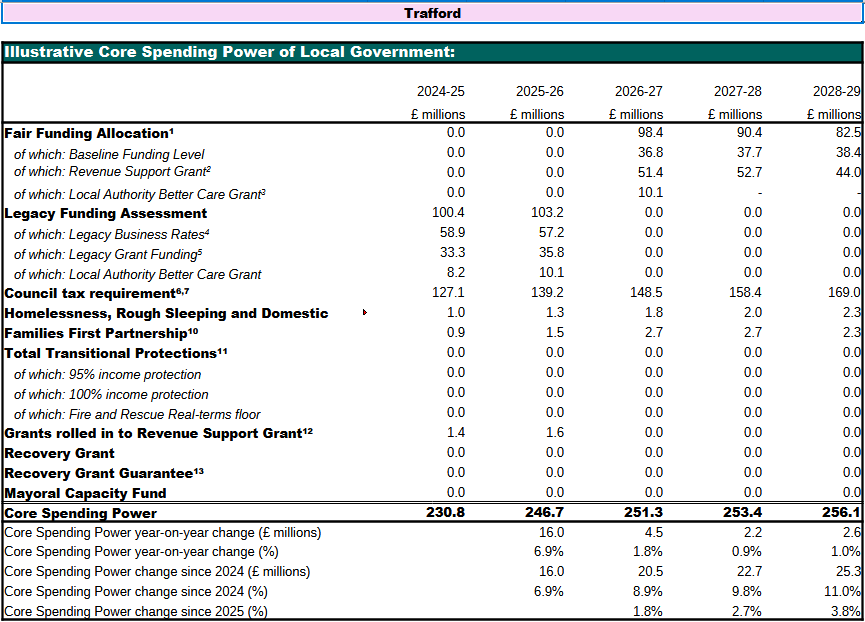

The Local Government Finance Settlement for 26/27

Despite the fact Trafford’s funding is entirely locally sourced, the Government (of all persuasions) is never going to allow Trafford free rein. In December each year the government issues the finance settlement.

For 26/27 England’s average increase in spending will be 5.7%.

Trafford’s increase will be 1.8%.

This assumes Trafford will increase its council tax by the 4.99% limit.

So, the starting point for Trafford’s budget setting is council tax going up by 4.99%, yet Trafford’s core spending will nudge up just 1.8%.

Only 1.8%! Where’s my council tax going? Where’s the increase going?

It’s a fair question to ask.

I suspect that both capitalisation direction (borrowing) and use of reserves were contributing to the current year’s spending power. The trouble is that they were one-offs and we haven’t got them next year. And it has to be stated that they haven’t got us out of a hole and the reserves are finite.

What about other councils?

We’re not alone nationally, but within Greater Manchester it almost feels as though we are. Greater Manchester has always been mix of the relatively prosperous alongside some of the poorest. That missing chunk of business rates is retained within Greater Manchester to support less prosperous areas here. That used to be fair.

My view is that the latest local government settlement is putting strain on the Greater Manchester consensus. Manchester Council is seeing a huge increase from this settlement, yet Trafford is a net contributor.

Nonetheless, our council tax on domestic properties is still low in comparison to our neighbours. Does it need to go higher again?

What next?

The draft budget needs to be published by midnight tonight. There has to be an emphasis on the word ‘draft’. Income is only half the story. We need the draft budget to understand spending pressures or easements.

Technically, the Local Government Finance Settlement is under consultation. I’m confident Trafford will have been making the strongest representation. There’s been some discussion in political journals that the calculation Government is making is favouring London by weighting the cost of housing. Instinctively, that feels like double counting since housing costs have to contribute to deprivation which is the major weighting within the settlement.

However, for Government to make changes to the formula would change everyone’s settlement. They’re not going to change the formula.

I think we do need to look at the Greater Manchester formula.

With regard to last year’s exceptional permission to borrow, I don’t think we ought to accept a regurgitation of that permission to borrow yet more money if that turns out to be government’s solution. That way is one-way and it ends in tears.

I want to understand business rate growth and that’s’ something I’m keen to see in the report. Trafford has benefited from growing its business rate base. That’s being reset by government but looking at the Old Trafford area, there is still potential to grow it still and that’s an aspect to give some optimism.

Finally,

The selfish reason for writing this that the writing is helping me understand the budget. I don’t want to rely on officers. I’ve had to go to core material. Hopefully, I’m able to share some of that knowledge and test it,

Leave a Reply