The Final Budget has been published, ready to be put to council on the 5th March.

Trafford Council Budget 2026-27.

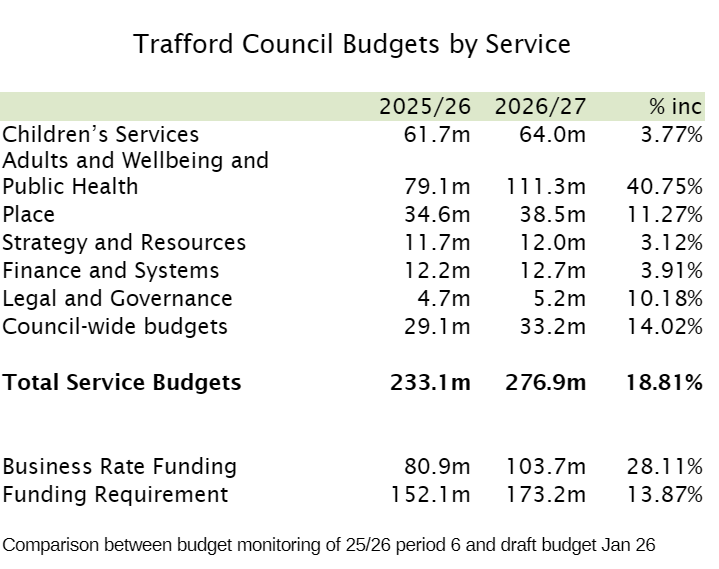

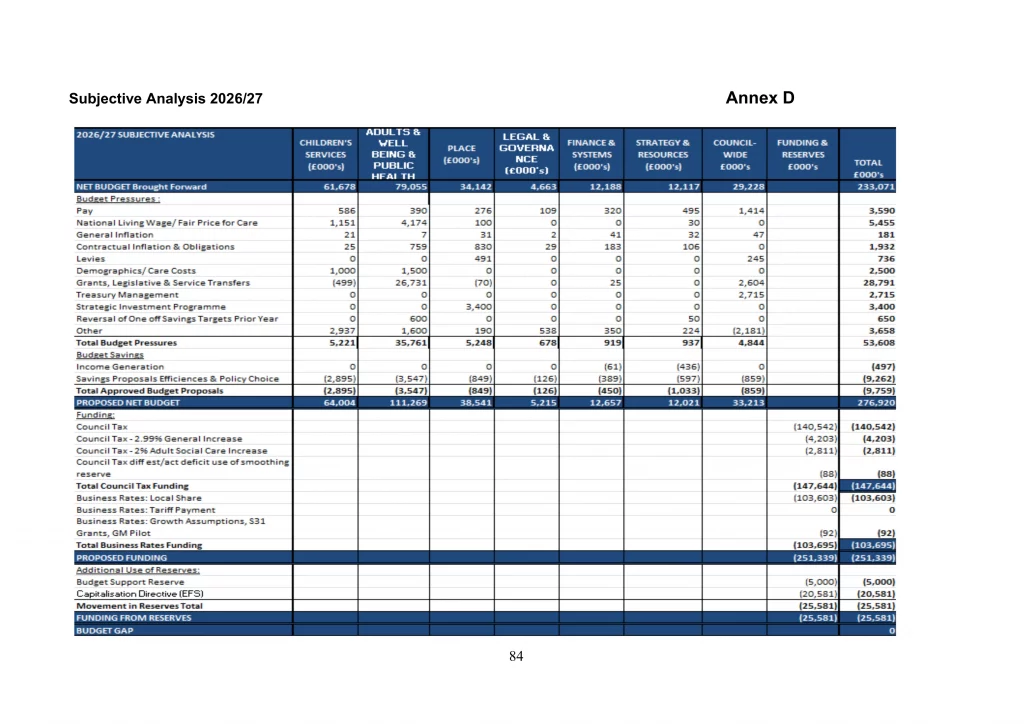

In terms of spending choices, as one would expect there’s not a huge difference from the draft budget released in January. The proposed net budget is £274m compared to the £277m originally projected, which is good. It’s about the only good thing on show.

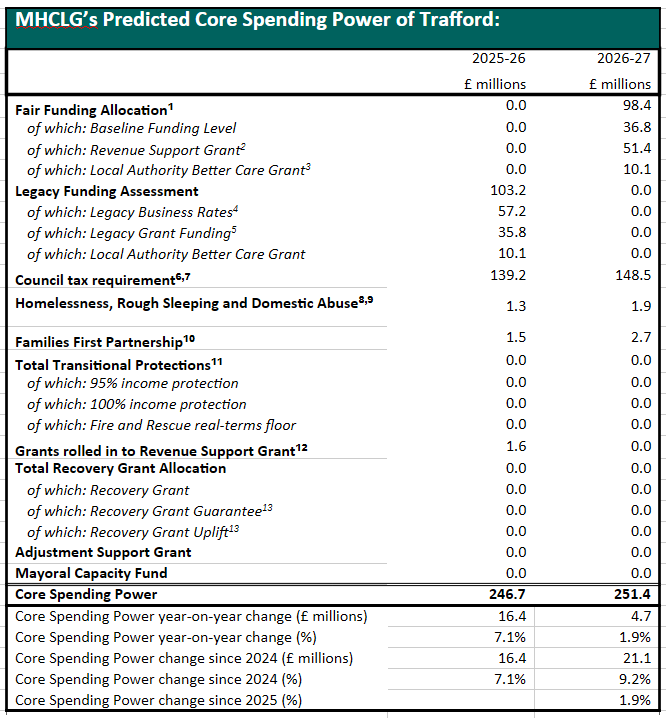

We knew that the Government had determined that we needed to be able to increase Council Tax by an additional 2.5% compared to the standard rise. That 7.5% is therefore built into this final budget.

We’ve been granted the facility to borrow £12.64m for the coming year. This is on top of borrowing £9.6m or thereabouts for the year that’s coming to an end.

Borrowing is not routine, it’s a seismic change.

The act of borrowing to support day to day spending has always been outlawed and rightly so! I don’t like it at all. Fundamentally, it’s borrowing from future budgets. It’s particularly worrying when future finances do not look any rosier.

Given this is a three year settlement, you would hope we could see light at the end of the tunnel, but there’s no sign yet of a balanced budget, albeit there is a narrowed gap in 2028.

I learn from the local democracy reporting service that Sefton is looking to a fire sale of assets to balance its budget. This seems to require Government permission.

Liverpool Echo Sefton selling off assets to balance budget

Trafford hasn’t committed using receipts from its land sales. However, the land sales plan routinely contains the paragraph:

Receipts generated from the disposal of sites as detailed in Category 1 and returns from development of sites detailed in Category 2 are currently earmarked to directly support the Capital Programme, although these could also be used to support the wider strategic management of Council borrowing.

They’ve not used receipts before, as far as I am aware, to support the management of borrowing, but we’ve never been in this position.

The more I think of Trafford, Warrington, Cheshire East and Sefton, the angrier I get on their behalf. I can’t believe how passively we’re all accepting this absolutely dreadful settlement from Government.

Yes, there’s an argument that our council tax level in Trafford is somewhat adrift from what it really ought to be to deliver the standard of service people want, but the comparison with Manchester’s settlement is just too extreme. The difference that’s going to become apparent between Old Trafford and Whalley Range is so unjustifiable it needs to be screamed at Government. I’m appalled.

Budget Documents

The 26/27 Final Budget Proposals (109) pages

Key Parts –

Report of the Director of Finance and Systems on the

Robustness of the Proposed Budget Estimates and the

Adequacy of Financial Reserves (Page 9)

Financial Background (Page 33)

The Budget – Page 59

Savings Proposals – Page 86

Treasury Management (Debt and Reserves)

Fees, Charges and Allowances (everything from parking to cremation charges)

Budget Scrutiny Response These are the executive’s answers to the recommendations of the scrutiny committee.

(The Scrutiny don’t seem to have been given access to questions over financing the budget gap. It’s certainly not raised.)

Given that effective scrutiny was particular emphasis of the peer review of Trafford, I don’t know that this serves Trafford.